The best way to e-file your W-2 form is to use ExpressTaxFilings.com. ExpressTaxFilings is a complete tax filing solution for 1099s, W-2s, and other IRS information returns. To get started, you can click on "New Users". To save time, you can log in with your email or Facebook account. Once inside, you will be brought to the dashboard. Here, you can see any unsubmitted forms you're still working on and also your completed forms. To get started on a new W-2, you can select the W-2 on the right to begin. You will need to enter the employer information by selecting an employer from the drop-down menu or adding employer information on this page. To be saved to your account, you can also use the "Add Multiple Employers" option if you would like to upload a list of employers within your account. There are also some e-file specific fields at the bottom where you will need to select which type of payer you are and whether this is a government or state employer. On the next page, you will need to enter employee information, including contact info and Social Security number. Once the employee information has been added, they will be stored within your account and the name will be listed under the drop-down at the top. Likewise, you can also use the "Add Multiple Employees" option if you would like to upload a list of employees within your account. On the W-2 form itself, you can complete es 1 through 14. If you have any questions about a particular , you can use the "Question Mark" on the right to get more information about what that section entails. On the next page, you can enter information about state income and withholding. You have the option of selecting multiple states...

Award-winning PDF software

instruction W-2 & W-3 Form: What You Should Know

Nov 10, 2025 — You may want to file a Form W-7 to notify the IRS of your spouse's death. You can find information for that form, what you need to do to prepare forms, and more at Tax Topic No. 982. Dec 17, 2025 — You may want to consider sending Form W-9 to your business to show employment taxes due. See our business section. Apr 5, 2025 — The Internal Revenue Service (IRS) has not issued tax dates for 2025 due to the end of the tax year. However, we have already posted information to help you file your forms prior to the IRS tax deadlines. See our business section. Oct 14, 2025 — The deadline for the 10% FICA tax rate for employees and contractors. However, for 2025 filing, you may be able to claim an exemption at the time you file your federal income tax return. For more information, see Tax Topic No. 983. Apr 30, 2025 — The Internal Revenue Service (IRS) has proposed changes to the 1098-SA form. The following are general points that you should familiarize yourself with. Feb 13, 2025 — You can file Form 5471 to report all capital gain (but not loss) or loss. This form may take 2 or more forms since it must be filed and paid electronically if you itemize deductions. See Capital gains and losses. May 1, 2025 — Withholding tax due on Social Security. See Publication 541 for more information. Sep 15, 2025 — You may be subject to the 10% FICA tax rate for some employees for the 2025 tax year (see IRS Publication 969). For more information, see our section on the federal and state FICA tax rates. Dec 31, 2025 — The FICA tax rate for most employees begins to increase. This rate will be adjusted for inflation. The Social Security tax rate is reduced by half. See our section on the FICA tax rates. May 15, 2025 — The IRS proposes to phase in the Social Security FICA tax rates. As of 2018, the tax rates are: 1% FICA tax on the first 118,500 earned, 0 for the next 118,500, 1.45% FICA tax on the next 117,000 earned, 2.10 for each additional 1,000 earned beyond that.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction W-2 & W-3, steer clear of blunders along with furnish it in a timely manner:

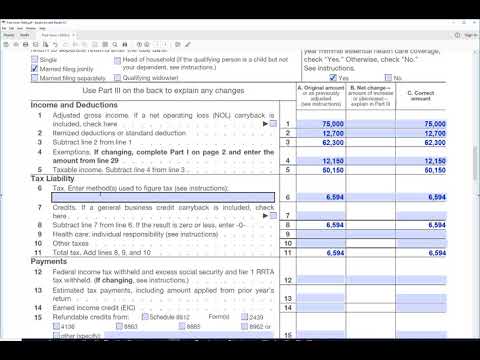

How to complete any Form instruction W-2 & W-3 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction W-2 & W-3 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction W-2 & W-3 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form instruction W-2 & W-3